The Pitfalls of Sustainability in Companies: Navigating the Challenges with Corbus

In today’s business landscape, sustainability has evolved from a buzzword to a crucial strategic consideration. Companies worldwide recognize the positive implications for their business, but they are grappling with the challenge of integrating sustainable practices into their operations while maintaining profitability and growth.

Opportunity: Corporations understand that sustainability can enhance brand reputation, drive innovation and open up new market opportunities.

Challenge: The path to integrating sustainable practices is often obstructed by short-term financial pressures, lack of expertise and the challenge of measuring and reporting on sustainability performance accurately.

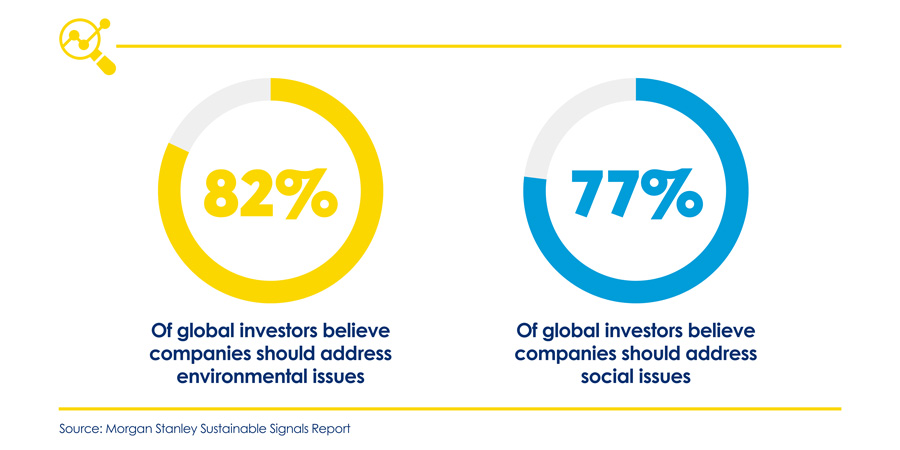

For investors, particularly equity firms, sustainability is becoming a crucial factor in decision-making. The rise of ESG investing reflects a growing awareness that sustainable companies often exhibit lower risks and generate long-term value. According to a report by Morgan Stanley, 85% of investors are interested in sustainable investing. The same studies show that ESG investing trends are expected to increase by more than 50% in the coming years.

Opportunity: A company’s commitment to sustainability can influence its attractiveness to investors, impacting valuations and access to capital.

Challenge: Inconsistent sustainability reporting standards and greenwashing—where companies exaggerate their sustainability efforts—pose significant challenges to investors seeking to make informed decisions.

At Corbus, we’ve observed the current state of corporate sustainability, its relevance to investors, future trends and the pitfalls companies need to navigate to achieve genuine sustainability.

Our expertise in strategy development and implementation can help companies overcome these obstacles and create a robust sustainability framework, including transparent and comprehensive sustainability reporting practices that align with investor expectations and regulatory requirements.

Sustainability’s Future Prognosis and Regulatory Trends

Looking ahead, the prognosis for sustainability in the corporate world is promising but complex. As climate change and social issues become more pressing, companies will face mounting pressure to address these challenges in meaningful ways. Regulatory pressures are expected to intensify, with governments worldwide enacting stricter environmental regulations and reporting requirements.

Key trends to watch include:

1. Stricter regulations. Governments worldwide are introducing more stringent sustainability regulations. The European Union’s Corporate Sustainability Reporting Directive (CSRD) and Sustainable Finance Disclosure Regulation (SFDR), as well as the U.S. Securities and Exchange Commission’s (SEC) proposed climate disclosure rules, are just the beginning.

2. Carbon pricing. More countries are likely to implement carbon pricing mechanisms, forcing companies to internalize the cost of their emissions.

3. Circular economy initiatives. Expect a greater emphasis on reducing waste and promoting recycling and reuse across industries.

4. Biodiversity focus. As the importance of ecosystem preservation gains recognition, companies will look to address their impact on biodiversity.

Corbus’s expertise in regulatory analysis and strategic planning can help companies navigate the evolving landscape effectively. Our global insights and industry expertise can help companies anticipate and prepare for these trends, positioning them for success in a sustainability-focused future.

Pitfalls in Corporate Approach to Sustainability

To prepare for the future, it’s important for companies to enhance their sustainability reporting, invest in green technologies and embed sustainability into their core strategies.

Despite good intentions, many companies fall into these common pitfalls when addressing sustainability:

1. Greenwashing. One significant pitfall is the superficial adoption of sustainability practices, often driven by the desire for positive publicity rather than genuine impact. Making misleading claims about environmental practices can severely damage a company’s reputation and lead to legal consequences.

2. Short-term thinking. Focusing solely on quick wins, rather than long-term sustainable transformations can limit the impact and benefits of sustainability initiatives.

3. Siloed approaches. Treating sustainability as a separate function, rather than integrating it across all business units can lead to ineffective implementation.

4. Scattered data. Many organizations lack standardized metrics for evaluating and scoring sustainability performance. The myriads of frameworks, such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB), can be overwhelming.

Corbus can help companies avoid these pitfalls by developing comprehensive sustainability strategies that are integrated into core business operations, ensuring authentic and impactful initiatives.

Preparing for the Future

Companies can find future success by staying ahead of regulatory trends and evolving market demands. This involves:

Developing a Clear Strategy. Establish a comprehensive sustainability strategy that aligns with business goals and regulatory requirements.

Staying Informed. Keeping abreast of changes in sustainability regulations and standards.

Building Expertise. Ensuring that board members and executives have the necessary knowledge and skills in sustainability.

Collaborating. Engaging with external experts and stakeholders to enhance sustainability practices.

Innovating. Investing in research and development to create sustainable products and services.

Standardized Scoring. Companies should align their reporting with widely recognized frameworks such as the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB).

Corbus collaborates with companies to develop clear, informed, and innovative sustainability strategies. We ensure standardized reporting and continuous improvement in sustainability initiatives.

The CFO Perspective on Sustainability

For CFOs, sustainability is not just a compliance issue but a strategic imperative that impacts financial performance. Sustainability initiatives can drive cost efficiencies, reduce risks and open up new revenue streams. CFOs play a crucial role in integrating sustainability into financial planning and decision-making, ensuring that sustainability goals align with the company’s financial objectives.

However, CFOs often face the challenge of quantifying the financial benefits of sustainability. This requires a comprehensive approach to cost-benefit analysis, considering both direct and indirect impacts. For instance, while the initial investment in green technologies may be high, the long-term savings and risk mitigation benefits can outweigh these costs.

Corbus’s expertise in financial modeling and value creation can help CFOs develop robust frameworks for assessing the financial implications of sustainability initiatives.

Partnering for a Sustainable Future

As sustainability continues to shape the corporate landscape, companies will be faced with navigating a complex maze of challenges and opportunities. By avoiding common pitfalls, embracing holistic approaches and integrating sustainability into core business strategies, companies can not only mitigate risks but also unlock new sources of value and competitive advantage. The future of business is sustainability, and those who adapt quickly and effectively will be best positioned to thrive in this new era.

Corbus stands ready to partner with companies on this journey, offering our deep expertise in strategy, operations and sustainability to help businesses navigate the complexities of the sustainable future and emerge as leaders in their industries.